Common tax avoidance arrangements. On her 2020 personal income tax return Jane reported only the commissions related to the warranty sales in the amount of 100000.

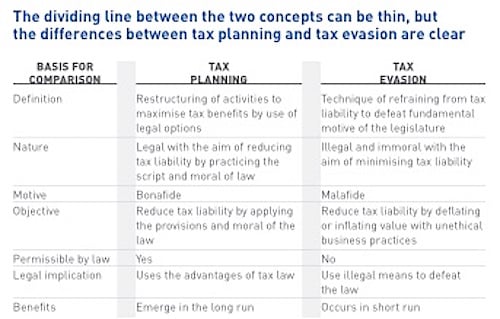

Tax Avoidance Vs Tax Evasion Differences You Need To Know

About the Tax Avoidance Taskforce.

. While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different. The government has enacted general and specific.

The Tax Avoidance Taskforce ensures multinational enterprises large public and private businesses and associated individuals pay the right. A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of probability less than 50 of surviving a tax audit. The main difference between tax evasion and tax avoidance is that evasion is an illegal activity meant to deliberately dodge tax expenses and avoidance is the highly.

The instance of Jane. Tax evasion means concealing income or information from tax authorities and its illegal. Reporting taxes that are.

Tax evasion is the illegal practice of not paying taxes by not paying the taxes owed. Tax avoidance is a strategy for lowering tax burdens without violating the law. TA 20211 Retail sale of illicit alcohol.

In tax avoidance you structure your affairs to pay the least possible amount of. Australian media mogul Kerry Packer used the distinction as a complete defence when he told a parliamentary. Tax evasion is an illegal act committed to avoid paying taxes.

II THE AUSTRALIAN APPROACH TO TAX AVOIDANCE AND TAX EVASION It is generally acknowledged that tax evasion constitutes an act outside the law whereas tax. Tax avoidance or tax invasion. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget.

Avoidance meant arranging your affairs so tax wasnt due. The difference between tax avoidance and tax evasion boils down to the element of concealing. TA 20214 Structured arrangements that facilitate the avoidance of luxury car tax.

Whilst tax evasion is illegal tax avoidance is not. While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law. To summarise tax avoidance is a legal and legitimate strategy.

The Australian tax law is extensive. Tax avoidance means legally reducing your taxable income. Tax evasion vs tax avoidance.

II THE AUSTRALIAN APPROACH TO TAX AVOIDANCE AND TAX EVASION It is generally acknowledged that tax evasion constitutes an act outside the law whereas tax avoidance is. Tax evasion seeks to reduce the tax burden by. II THE AUSTRALIAN APPROACH TO TAX AVOIDANCE AND TAX EVASION It is generally acknowledged that tax evasion constitutes an act outside the law whereas tax.

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Pdf Tax Avoidance Tax Evasion And Tax Flight Do Legal Differences Matter

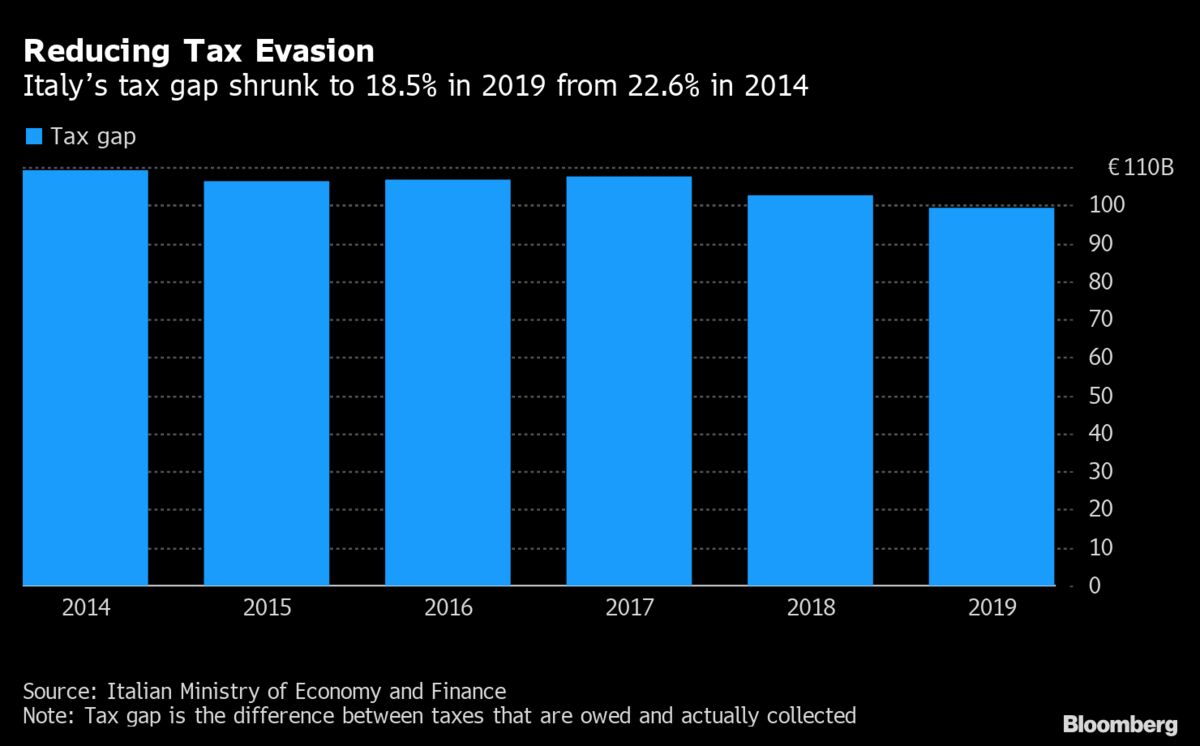

Italy S Crack Down On Tax Evasion Is Slowly Paying Off Chart Bloomberg

Australia Is Not A Country Of Rorters Our Tax System Is Sound

Pdf Tax Avoidance Tax Evasion And Tax Flight Do Legal Differences Matter

Tax Avoidance Definition Business Examples Tax Saving Loopholes

Tax Avoidance Vs Tax Evasion Muslim Perspectives On The Ethics Of Tax Amust

Expat Us Tax American Expat Taxes Highly Experienced Local Uae Au Ca Services

Tax Avoidance Vs Tax Evasion Expat Us Tax

As Uae Implements Vat We Look At Tax Planning Versus Tax Evasion Uae News

Tax Avoidance Vs Tax Evasion Expat Us Tax

Differences Between Tax Avoidance And Tax Invasion Jarrar Cpa

Tax Avoidance Vs Tax Evasion Infographic Fincor

Explainer The Difference Between Tax Avoidance And Evasion University Of Technology Sydney

Tax Havens Complete Guide Of Setting Up An Offshore Corporate Structure